Click below to jump to the topic:

Workforce

Looking for a part-time job while in school? Have a job after you graduate? This page provides valuable information to help you land a job and important infirmation once you’re hired!

Where do I get a workers permit?

Working permits are used when minors (under age of 18) apply to work while in school.

You DO NOT need a working permit until you have a job offer.

Working permits are available at any WPHS staff center and from Ms. Morgan in E207a. OR can be found online: https://laborfiles.delaware.gov/main/dia/olle/Work_Permit.pdf

Know Your Rights! Click here to learn about Child Labor Law

Can I earn course credit for working?

Yes, you can earn 1.0 credit toward graduation through William Penn’s Work-Based Learning Program for job experience while in high school.

Contact Anna Morgan for details

Send a Schoology Message

Location: Room E207a (across from E2 staff center)

Resumes

Writing Your First Resume

A resume is a summary of your qualifications for a job. The document highlights your past experiences and skills that would make you a good fit for the position.

Your resume is your first impression to prospective employers so you’ll want to make sure it looks professional and is free from spelling and grammatical errors.

Common mistakes to avoid:

- High School is two words and should be capitalized

- Capitalize all proper nouns (names such as William Penn High School, your first and last name, street address, city, state, businesses where you have worked before etc.)

Click buttons below to view helpful articles and resources

Interview Tips

Networking

Networking is a key part of job hunting. All it means is talking to others—either formally or informally—about your job search and career goals.

Networking facts

- It is not the same as asking for a job. Usually your networking contacts will not be potential employers.

- It helps you learn inside information about jobs that are being created.

- It lets you tap into the “hidden network”—the many jobs that are never advertised.

- It’s helpful for ongoing professional and personal development.

- An employer who is not hiring today may be looking for someone like you tomorrow.

Before you begin networking, be clear about your job search goals

Think about what you want to say to others about yourself, and what you want to know from them.

- What kind(s) of job(s) are you looking for?

- What skills and experience prepared you for these jobs?

- Are you focused on a particular industry?

- Do you want to find a job at a particular company?

- Do you want to look for jobs in one local area?

(CareerOneStop, 2025)

Click buttons below to view helpful articles

Job Applications

Interview Tips

Know Your Rights

Professionalism

Finance: Understanding Paychecks & Taxes

Key Terms

- Paystub: A document that provides details about a worker’s earnings for one pay cycle

- Paycheck: The actual check that can be cashed or amount of money that is directly deposited into your bank account; the net pay earned

- Gross Pay: The total amount a person earns by working

- Net Pay: The part of the worker’s earnings they get to keep after taxes and benefits have been subtracted; the “take home” pay

- Wage: The hourly rate a worker is paid

- Income taxes: State and Federal taxes are deducted from each pay; you may get a portion back each spring when you submit your Tax Forms by April 15th

- Benefits: When you work full-time, employers can offer benefits such as medical insurance or retirement savings accounts; usually a portion of each pay is deducted for these benefits

How to Read Your Paycheck

When you receive your first paycheck, you will notice that state and federal income taxes have been taken out. Watch the video below to learn why!

Gross Pay vs. Net Pay

Gross pay is what employees earn before taxes, benefits, and other payroll deductions are withheld from their wages. The amount remaining after all withholdings are accounted for is net pay or “take-home” pay. You should create your personal budget using your NET PAY.

Income Taxes

Income taxes are fees taken out of your paychecks (income) from the government.

Every year, you will fill out required tax return forms to see if the amount of income taxes is equal to what you owe. Most people will get some money back during this time and others will owe more.

Click the buttons below to view additional helpful videos

Insurance

Insurance is a contract in which an individual pays money to an insurance company (called a premium, usually paid monthly, quarterly, or annually) to help safeguard in the event of an accident, illness, damage, or tragedy. When these unexpected things happen, insurance can help cover the costs.

For example, you will pay a monthly amount for car insurance. If you were to get in an accident, the repairs for the damages can cost thousands of dollars. The insurance company can help cover most of those expensive costs.

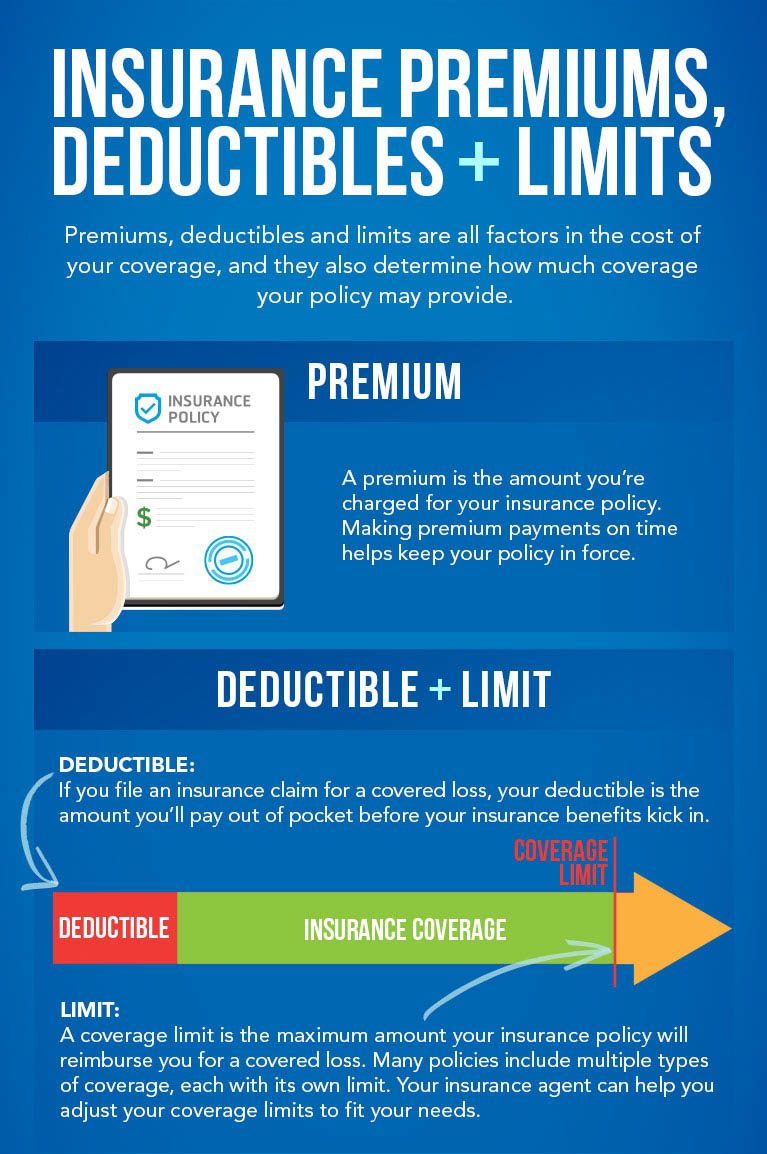

The rate that you pay for your premium depends on a variety of factors and is not the same for everyone. The cost of an insurance policy is determined in part by your premium, coverage limits, and deductible.

Key Terms:

- Premium: the amount you’re charged for your insurance policy. Making premium payments on time helps keep your policy active.

- Deductible: If you file an insurance claim for a covered loss, your deductible is the amount you’ll pay out of pocket before your insurance benefits kick in.

- Limit: A coverage limit is the maximum amount your insurance policy will reimburse you for a covered loss. Many policies include multiple types of coverage, each with its own limit. Your insurance agent can help you adjust your coverage limits to fit your needs.

Types of Insurance:

-

-

- Life

- Homeowners or Renters

- Auto

- Health

- Travel

- Pet

-

Click the buttons below to view additional helpful videos